closed end credit disclosures

2 The number of payments or period of repayment. The terms of repayment.

What Is A Closing Disclosure Lendingtree

2 Prohibits unfair mortgage lending practices.

. 12 percent Annual Percentage Rate or a 15 annual membership fee buys you 2000 in credit. If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of conversion. Open Line of Credit.

Closed End Credit is defined 2262 as credit other than open-end credit. If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. Disclosure section of the Closed End Loan Disclosure Statement.

Trigger terms when advertising a closed-end loan include. Closed-End Credit vs. Relates to closed-end credit.

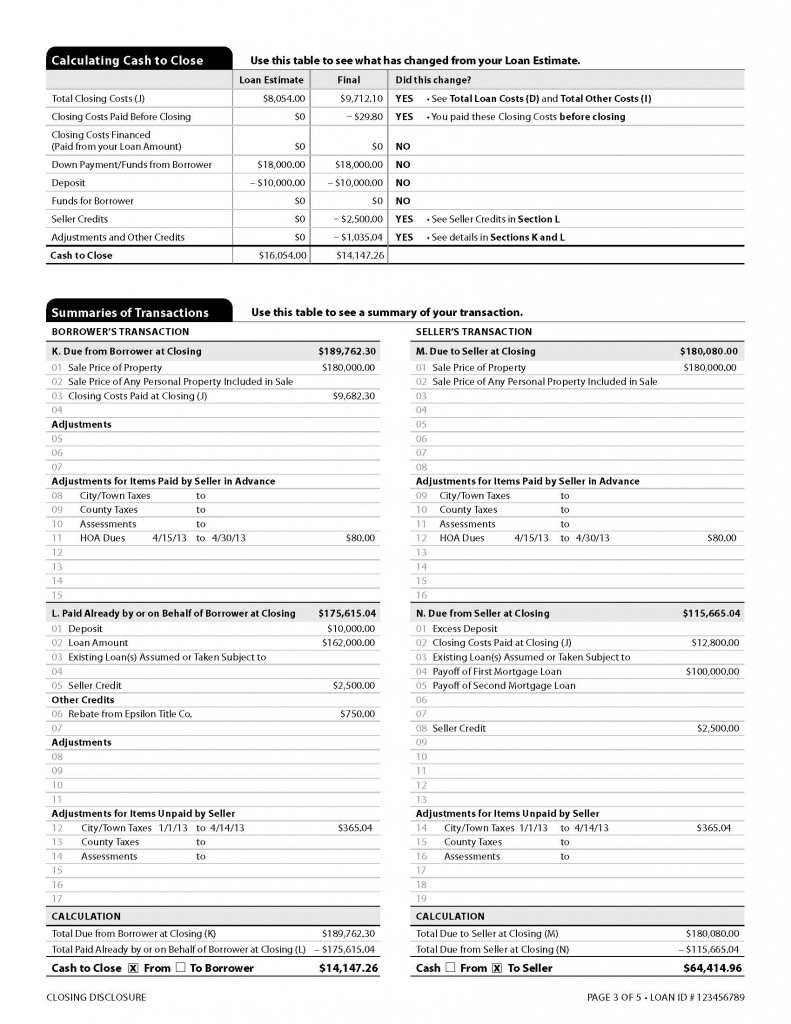

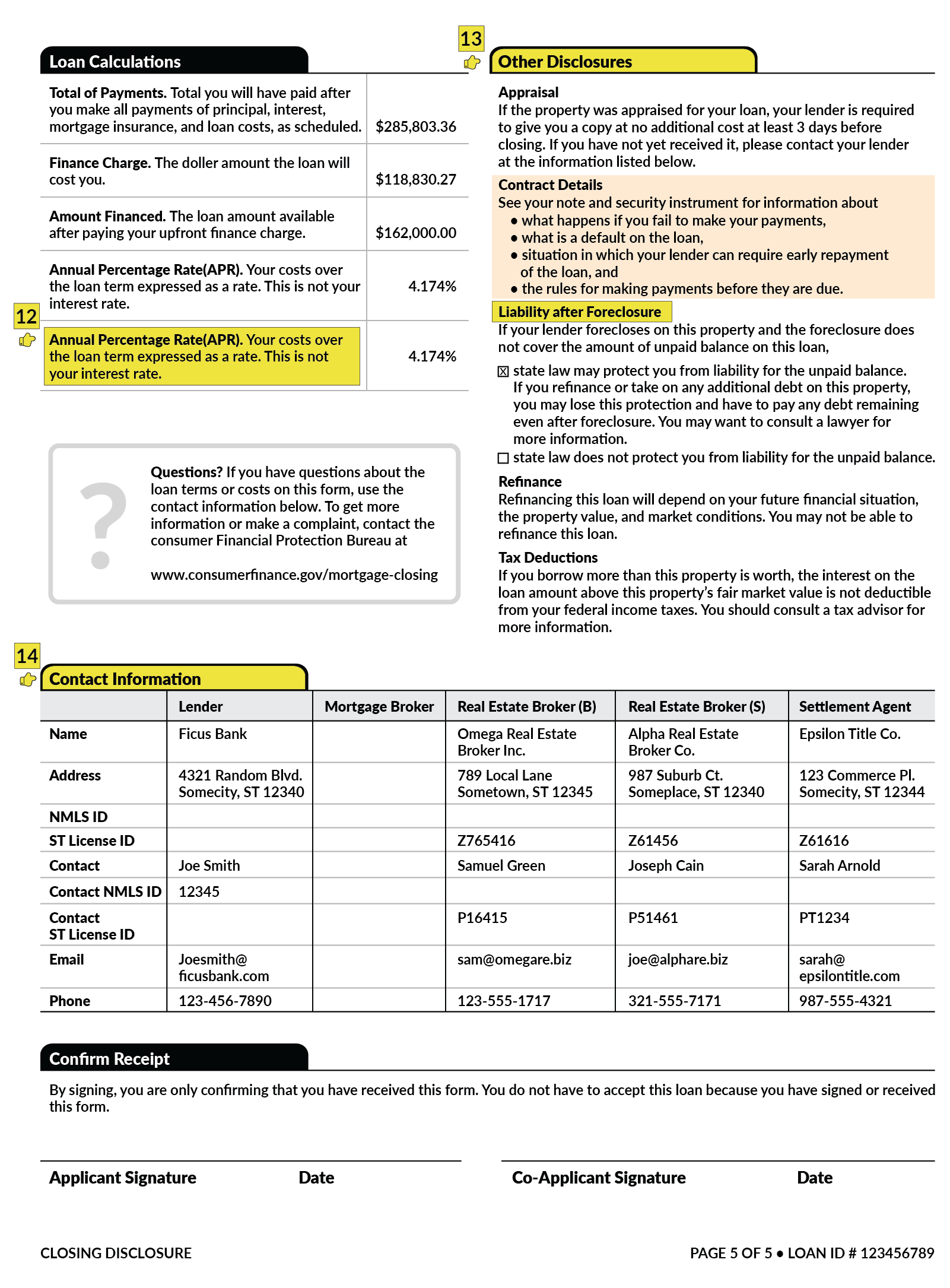

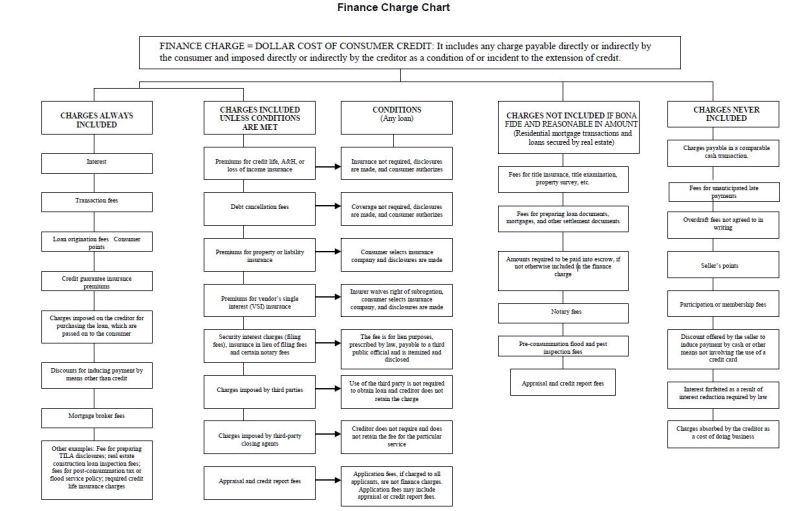

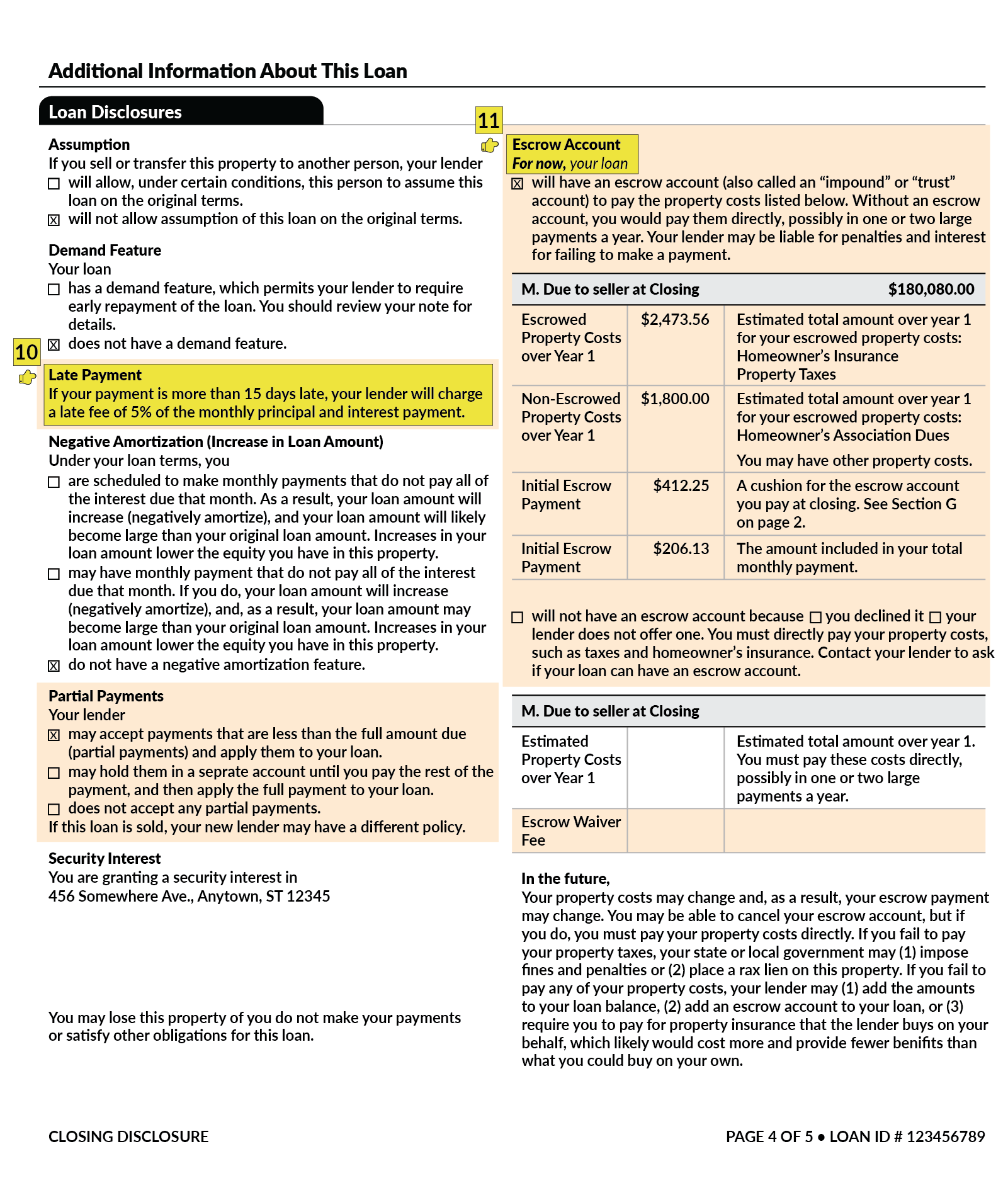

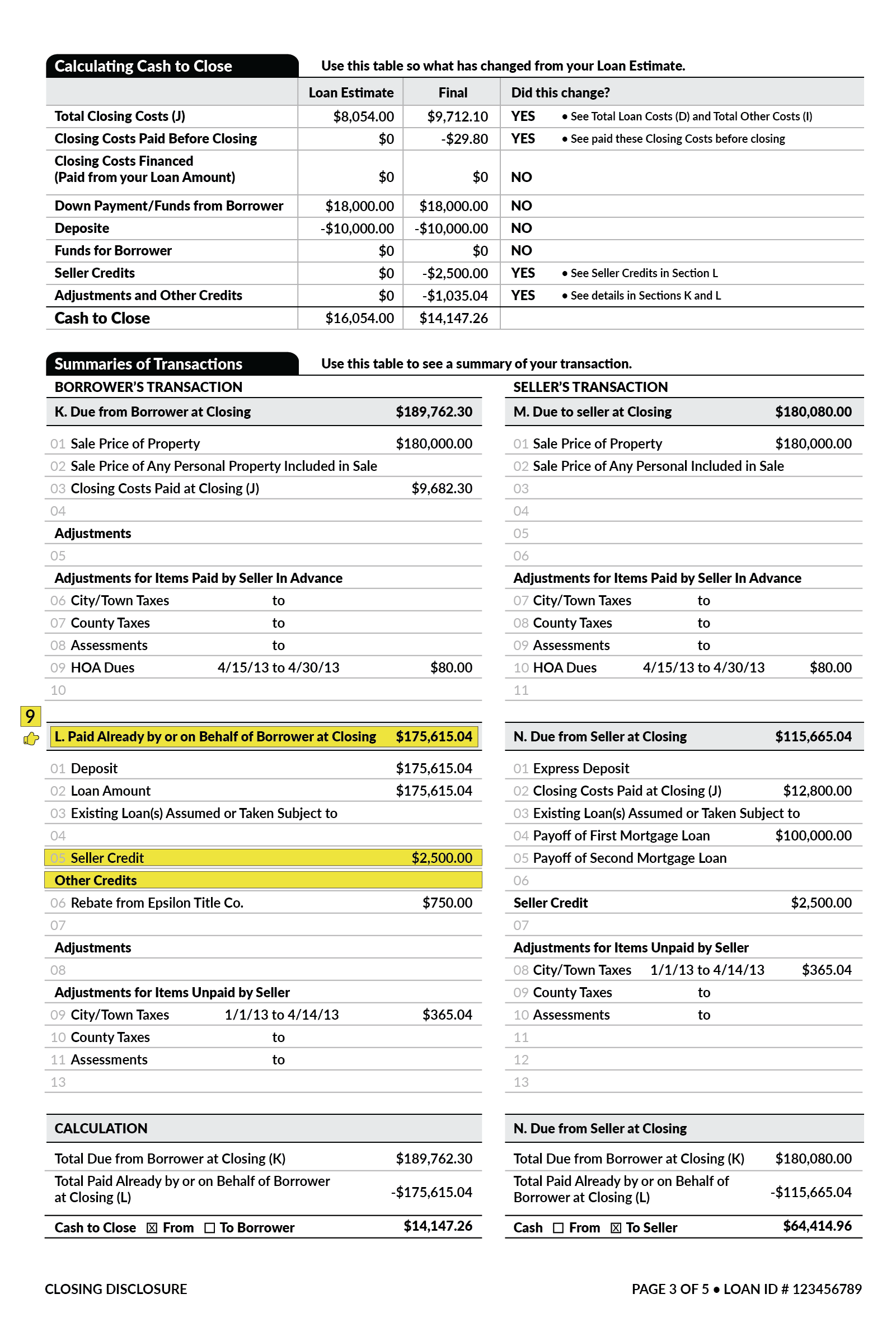

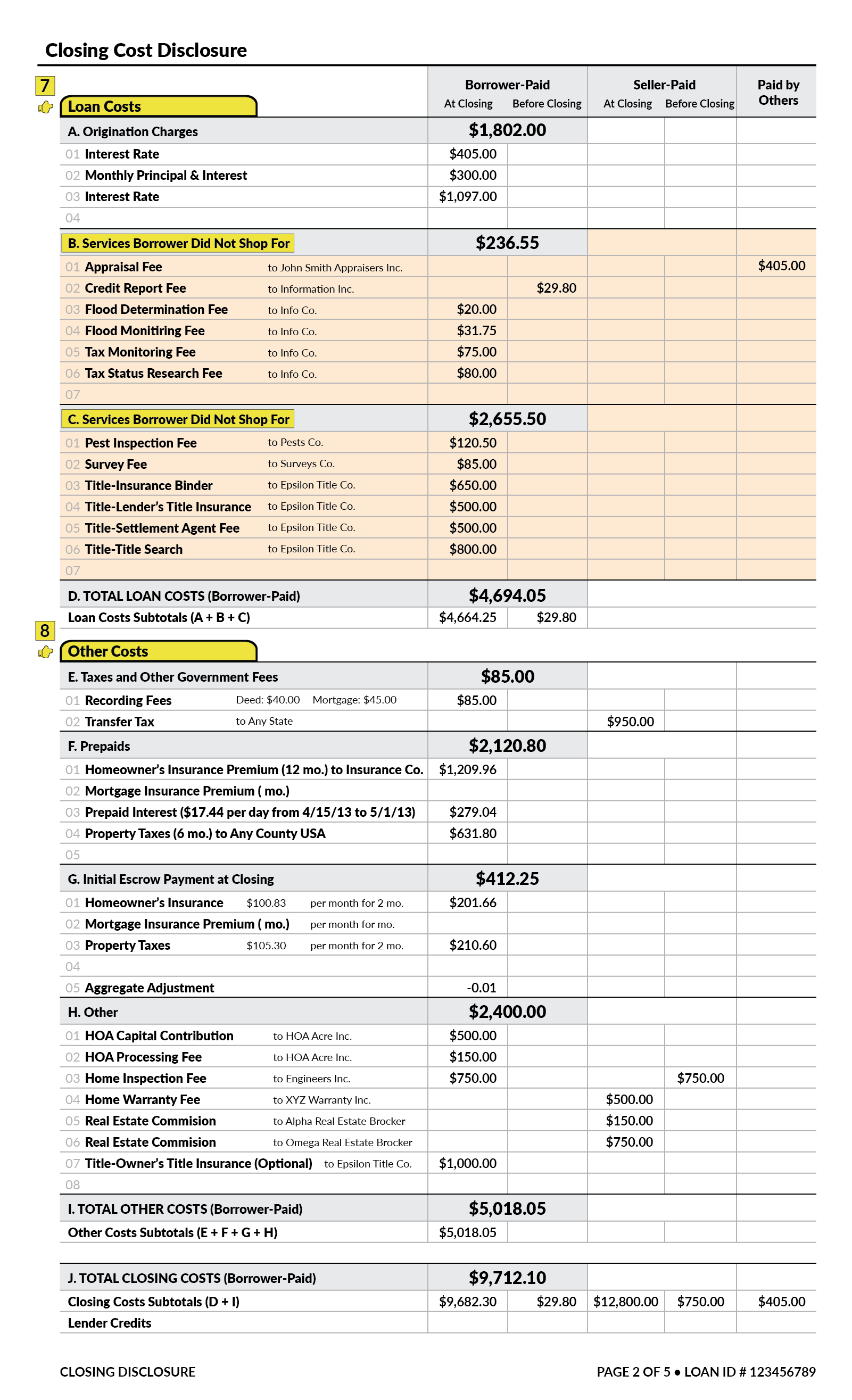

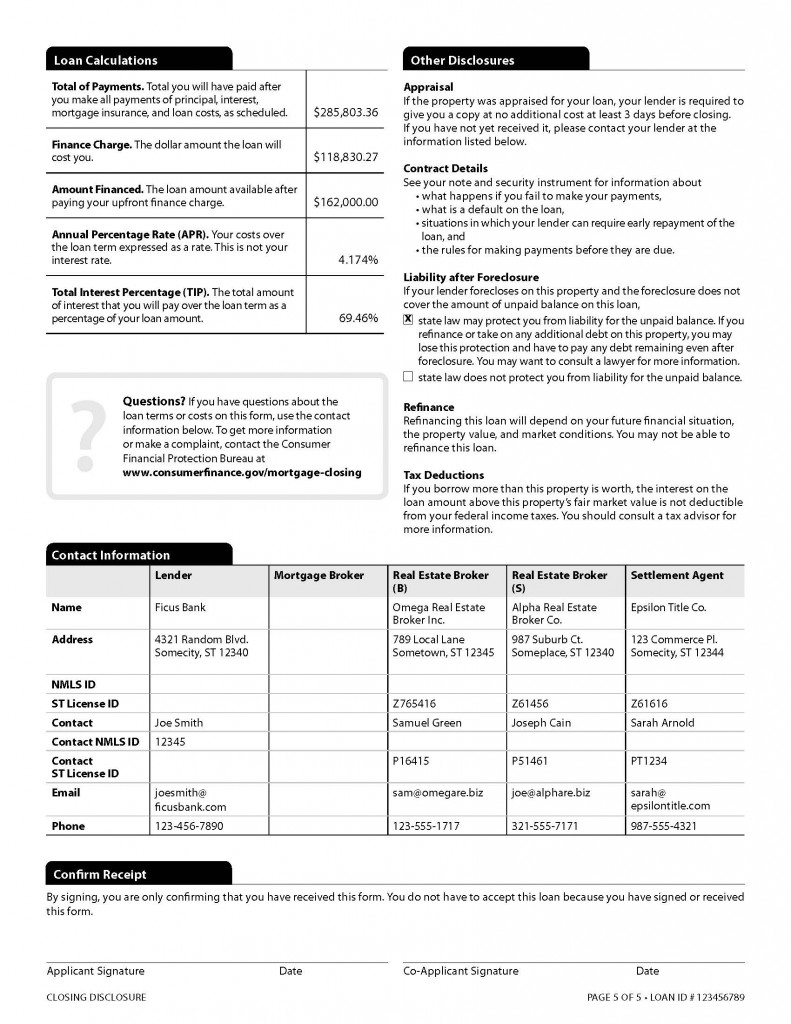

Fair Credit Billing Act Truth Lending Act Credit Card Act Closed-end Credit Operations and Procedures. Subpart AProvides general information that applies to both open-end and closed-end credit. For mortgage loans the disclosure statement is called the closing disclosure.

Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements. The amount or percentage of the down payment. The annual percentage rateusing that term spelled out in full.

3 Allows consumers to exercise their rights regarding disputes and billing errors. 102638 Content of disclosures for. 10153D determine that the creditor disclosed a statement that there is no guarantee the consumer can refinance the transaction to lower the interest rate or periodic payments.

Closed-End Credit Disclosure Forms. If this is a variable rate loan the Loan Amount section as set forth in the Closed End Loan Disclosure Statement tells you whether if the interest rate increases you will have to make more payments higher payments or if the final payment will be a balloon payment. Disclosures provided on credit contracts.

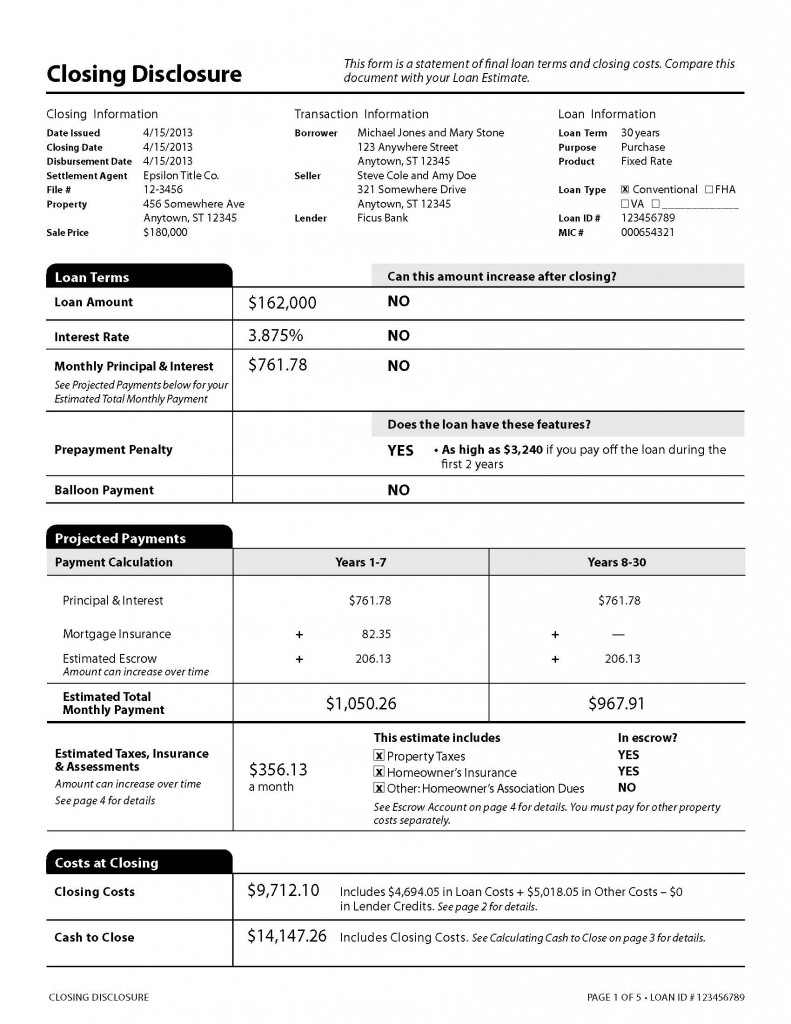

The disclosures required under subsection a with respect to any open end consumer credit plan which provides for any extension of credit which is secured by the consumers principal dwelling and the pamphlet required under subsection e shall be provided to any consumer at the time the creditor distributes an application to establish an. Item Description Yes No NA. Annual Percentag e Rate Definition 12 CFR 102622 Closed -End Credit 24 SUBPART B OPEN-END CREDIT 27 Time of Disclosures Periodic Statements 12 CFR 10265b 27 Subsequent Disclosures Open-End Credit 12 CFR 10269 28 Finance Charge Open- End Credit 12 CFR 10 266a1 10266b3 29.

Sample List of Closed-End Residential Mortgage Disclosures Required to be Given to Consumers at Loan Application by Maryland Mortgage Lenders and Brokers Updated January 2014. A trigger term is an advertised term that requires additional disclosures. The Credit Union will provide the proper closed-end disclosures to the consumer borrower before consummation of the transaction.

15 USC 1681gg Note. The disclosure rules of Regulation Z differ depend ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages. Depending on the need an individual or business may take out a form of credit that is either open- or closed-ended.

See the commentary to 10265 regarding conversion of closed-end to open-end credit 3. The use of positive numbers also triggers further disclosure. This disclosure should be made as soon as.

For residential mortgages and extensions of credit secured by the members dwelling the disclosures must be provided within three 3 business days after receiving the. 1 The amount or percentage of any downpayment. If the annual percentage rate may be increased after.

102637 Content of disclosures for certain mortgage transactions Loan Estimate. Closed-end credit is a loan or type of credit where the funds are dispersed in full when the loan closes and must be paid back including interest and finance charges by. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance with 102637c and 102638c as required by 102619e and f.

3 The amount of any payment. Regulation Z is structured accordingly. 4 The amount of any finance charge.

For a closed-end credit transaction subject to 102619e and f opens new window real property or a cooperative unit does the credit union provide disclosures required under 102637 opens new window Loan Estimate and 102638 opens new window Closing Disclosure. 1 Requires standardized disclosures regarding terms and how fees are calculated. The premium may be disclosed on a unit-cost basis only in open-end credit transactions closed-end credit transactions by mail or telephone under 102617g and certain closed-end credit transactions involving an insurance plan that limits the total amount of.

For a closed-end transaction secured by real property or a dwelling other than a transaction secured by a consumer窶冱 interest in a timeshare plan described in 11 USC. An advertisement including any of the previous triggering terms must also include each of the following disclosures as applicable. Subpart D sections 102625 through 102630.

Annual Percentage Rate Definition 12 CFR 102622 Closed-End Credit 28 SUBPART B OPEN-END CREDIT 31 Time of Disclosures Periodic Statements 12 CFR 10265b 31 Subsequent Disclosures Open-End Credit 12 CFR 10269 32 Finance Charge Open -End Credit 12 CFR 10 266a1 10266b3 33. FCRA FACT Act Credit Score Disclosure Cite. It contains rules on disclosures 102617 - 20 treatment of credit balances 102621 annual percentage rate calculations 102622 rescission right 102623 and advertising 102624.

All closed end credits subject to Reg Z both non-mortgage and mortgage loans get a transaction disclosure at the time the loan is closed. Transaction disclosures doe non-mortgage loans are typically referred to as the disclosure statement. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form.

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Consumer Compliance Outlook Understanding Finance Charges For Closed End Credit Implementing The Consumer Compliance Rating System Nafcu

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

What Is A Closing Disclosure Lendingtree

Can I Get A Hud Florida Agency Network

Federal Register Truth In Lending Regulation Z

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Truth In Lending Act Tila Consumer Rights Protections

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau